Insurance companies are currently updating themselves, offering total protection to all users. Regardless of what kind of event may be presented, offering a insurance policy and go about your daily life with peace of mind.

What is an Insurance Policy?

In this article we will be making known everything related to the improvements that insurers have in Mexico, making it possible to carry out some operations in cyberspace, such as paying for your contract. It's important to know What is insurance policy? before making a contract.

It is an agreement where one of the interested parties, called the insurer, is obliged to remedy any event, to cover the amount in pesos or in another currency for those affected.

When a verification of the event is made that is already indicated in the negotiation letter, as an exchange of the payment of the cost, which is called the premium, by the insured. The insurance policy is intended to deal with any type of risk if there is any benefit that can be protected.

The insured may agree with the contracting party, who undertakes to make the payments until the entire premium is completed, having as a benefit a coat offered by the insurer, avoiding that at the time of any mishap he has to pay a sum out of pocket superior, if the sinister will occur.

La insurance policy, has duties and remuneration that comes from both parties, starting when the agreement is signed.

Pay the Insurance Policy online

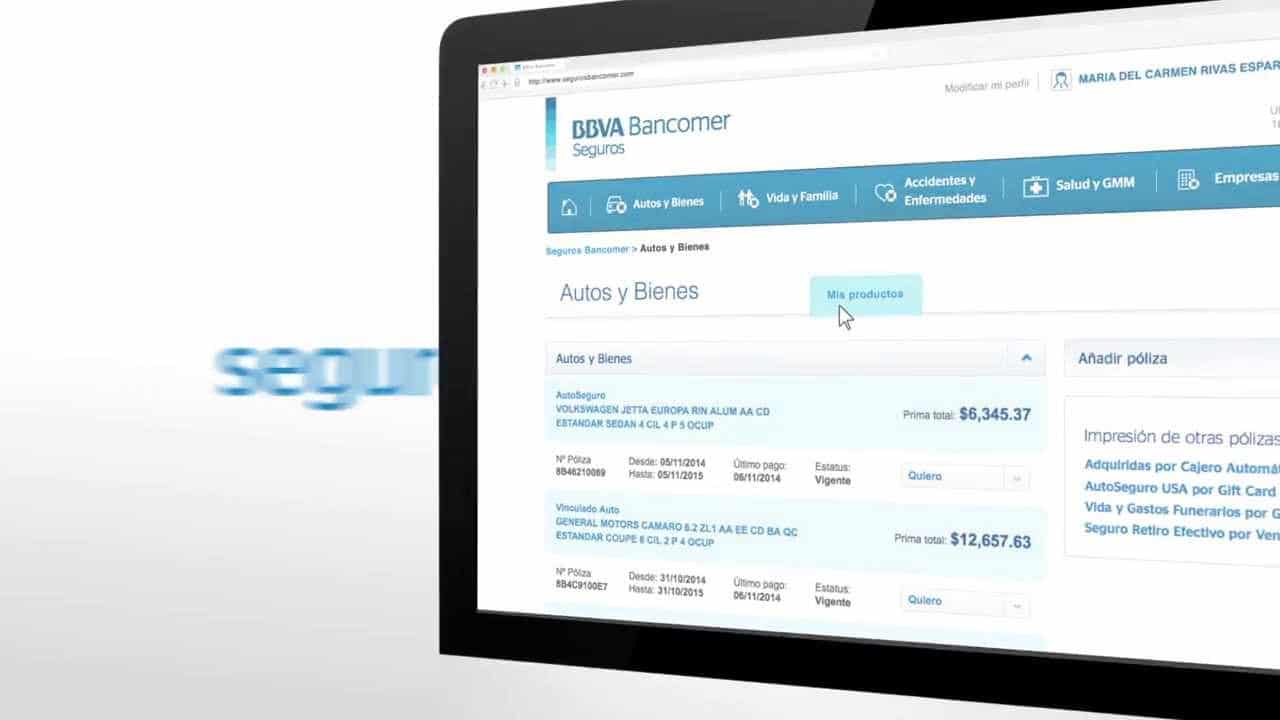

First, the customer insurance policy that you want to cancel through the web, you have to enter the legal platform of the company where you have a contract. When you are on the page, you must locate the area for clients or users, to carry out the respective registration by placing all the necessary information and locating it in the company contract.

After having created the personal account within the page, what follows is to locate in the menu “Premium Payment" or "insurance payment"(as the case may be, in some cases you can change the terminology depending on the company), what follows is to indicate how the payment will be made, the channels used for this purpose are the following:

- Credit Card, can be Visa or MasterCard.

- Make the charge to the current account of a bank entity.

- Make a transfer online.

When the way in which the payment will be made is already defined, it is essential that the personal information and the instrument that was selected to cancel, such as the card or checkbook, be also placed, in this way the collection of the corresponding fee to the policy will be executed. online insurance automatically and without wasting time.

Just wait a few minutes for the payment invoice information to be given, which is sent by the same means of the web, with this the payment of the premium is certified. It is extremely easy.

Requirements to Make Insurance Payment Online

When the payment of the insurance policy digitally, all you need is the serial of the certificate that the client has.

This numbering is the one that identifies the user in the insurance company where the contract belongs, when giving this information he immediately has as a response the amount that must be paid, the date that it is time to pay and all the data that is connected with the client's record. .

Supplementing what was said above, it is necessary to know the methodology of how the transaction will be carried out, which must be confirmed by the company that has the insurance policy using cyberspace, knowing that these channels are different between each insurer.

To finish, the user needs to make his payment online is to have enough funds to cover the amount of the fee, to have a connection and with only a few free minutes to carry out the process, the important thing is to do everything as indicated and finish with the payment. payment of the insurance policy.

Advantages of having Online Insurance

The advantages that stand out most when having an insurance policy that has a page in cyberspace are listed below:

- One of the advantages of having an insurance company that has a web platform is that the payment transaction is carried out in a comfortable way without wasting time.

- It is no longer necessary to go to a bank office or box office to make the deposit of the insurance fee, now the debt can be canceled from the workplace or at home.

- Also making the payment of the insurance online throughout the Mexican territory is to allow to have a debt-free negotiation with the company, with this it is avoided that you have to pay a percentage for late payment, if the deadline is passed, achieving in a good way that all these advantages that being affiliated to this type of treaty can have.

- The last advantage to be mentioned, but this does not mean that it is the least important, is that the payment of the insurance fee can be made at any time and at any time, there are no schedules to do it, with this it is clear that No time will be wasted fulfilling the commitment to pay and letting the deadline pass and then having to cancel a percentage for that reason.

With this it is clear that it is beneficial to have insurance that has an online system.

The Most Important Insurance Companies in Mexico

Mexico has a huge list of insurance companies, it is difficult to know which of them is the best when selecting, that is why a group of them was selected, to let you know the benefits of each of them.

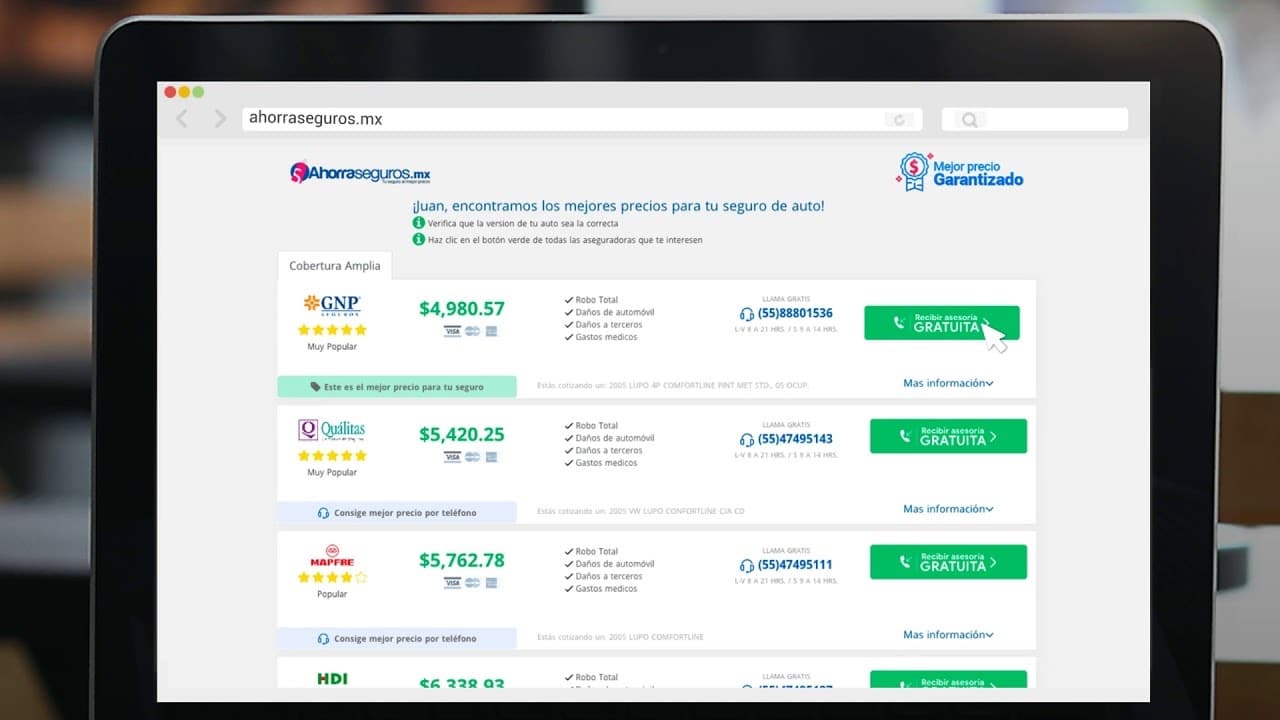

Qualitas Insurance. It is one of the insurances that is taken into account and it is suggested to select it at the time of affiliation throughout the Mexican territory.

This insurance company that is providing service throughout the country, its specialty is making contracts for automobiles and has been in the market for more than twenty years of practice with Mexican customers.

Standing out from the rest of the companies dedicated to this work, since its coverage is superior, with state-of-the-art technology that guarantees all users of this company.

AXA Seguros. This is an insurance association that has the peculiarity of being internationally recognized, having been in the market for thirty years of experience and with more than one hundred million policyholders worldwide.

Like Quálitas, the firm AXA is a specialist in insurance policies for cars, protecting all kinds of cars you have and how its terms are not rigid when it comes to its financing packages.

BBVA insurance. Insurance corporation that offers insurance policies for automobiles and also has contracts for home, health and life insurance. It is the right insurer when it comes to protecting the entire family group.

The BBVA insurance company captivates its users because in one place you can obtain insurance for everything you need to protect, thinking about family health, such as car protection or self-care.

When it comes to how easy it is to register and purchase a contract, BBVA as insurance stands out from the other similar companies mentioned in this description.

National Provincial Group Insurance. Insurance that is called by its initials (GNP), in this market it is one of the most experienced in the entire country, and with this comes the trust that it has generated over the years to make life and car insurance contracts. .

The packages that GNP has are created to adjust to any unique situation that the client has, protecting the beneficiary in a way that no other company can do due to the type of risk that can occur and is covered.

Mapfre Insurance. To end the list, mention will be made of this insurer that is growing more and more every day in the last ten years.

Which has the name of Mapfre Seguros, and provides service giving the benefit of complete coverage compared to others in its category, to provide security to the cars that are in the country.

This Mexican company has good costs in its policies and an organization that protects without a record, this must be taken into account when selecting an insurer that protects the vehicle without wasting time and in a good way as well as at the family level.

Categories of Insurance Policies

Next, several types of insurance policies will be shown that will expand knowledge when selecting a plan. Basically these are the insurance classes:

- Against other people or third parties.

- Third parties or total persons.

- And the full irrigation.

Depending on the company, they have different packages and protections, made according to what the client needs. It is important to know what these contracts contain, for that a insurance policy example and different classifications:

Civil Liability or for Other People. You are covered for claims that may occur due to damage caused by the person who insured, to other people or property such as a car; covering up to the amount that is assigned in the contract. In insurance parlance it is calledCoverage A”, which can be contracted for any car that is in circulation.

Losses Total. It is committed to having civil liability coverage for other people, also covering theft or robbery, fire claims and damages caused in any event, if the result of the accident exceeds 80%. This type is calledCoverage B".

Full Third Parties. It takes care of what happened to other people, if it is due to theft or robbery, in cases of fire damage, if the damage is complete or only a percentage. When an accident occurs, nothing else is covered if there was a complete loss of the car. This plan is namedCoverage C".

Full of risk. It takes responsibility and commits to damages to other people, if there is any theft or robbery, damages due to inflammation, complete or only a percentage.

It may be that it has a deductible, depending on the clauses of the contract and the responsibility is assumed by the insured. Is called "Coverage D".

Note: The Traffic Law says that all cars must have an insurance receipt in order to move around the territory. As an obligation, the insurance policy must at least be simple, where it is covered for damages to other people and their properties, caused by an event.

When an interested party selects a plan, this contract commits the insurance company to cancel the cost in currency to the insured for the loss that occurred, as stated in the clauses of the signed document.

Articles that may be of interest to you:

Request Consultation of the Mexican Gas Company Receipt

Check Balance and Pay Wizz Internet in Mexico

Request Consultation and Gas Payment Naturgy Mexico