Today we want to talk to you about Banco de Crédito e Inversiones de Chile, better known by its acronym BCI. Thanks to its stupendous and impeccable performance since its inception back in the 30s, it is valued as one of the most prestigious and important financial intermediation institutions in that nation. Positioning itself in the Chilean market as the third in terms of placement of capital, and as fourth in the list of clients. It also has the best digital profiles today, and in this post we want to show the user how to get BCI internet key, in order to improve their interaction and self-management with this remarkable institution. Keep reading and process your BCI internet key now!

How to activate the BCI transfer key?

Indeed, Banco de Crédito e Inversiones or BCI has a long and fruitful history to its credit, as it dates back to 1937 when a group of visionary Chileans decided to start their own financial company, with the aim of providing modest but timely economic support to small and medium emerging companies in Chile.

From its roots, the BCI has been characterized by its sustained quality services, solidarity, innovation, and a decided north, which is none other than paying attention to the different sectors of the economy of that nation.

This bank stands out in the Chilean financial market thanks to its high standards in its services in favor of its clients and/or users of its resources. It has always directed its innovative action to meet the demands and meet the economic needs of Chileans, whether of a natural or legal nature.

It provides a wide range of banking products and services to all these sectors, adopting new digital developments in its operations, products and services at all times. In many of which can be accessed using the BCI internet key.

As it could not be otherwise, the BCI has as its institutional mission to lead the financial market in Chile and other countries in the world where it can reach with its efficient economic/financial muscle. Likewise, to innovate and pleasantly surprise its clients and partners, maintain and expand the closeness and satisfaction of its clients' needs, while being recognized as the best and efficient company to perform and develop professionally and personally.

In this sense, it is essential to have all the digital instruments that allow an effective and efficient use of the digital and contact channels offered by the entity. Part of this instrumental package includes the BCI internet key, since with it you can make transfers, service and card payments, credits, purchases, etc.

In other words, it makes life easier for the user when operating through the Bank, adding time and managing a good part of the payment commitments online.

In such a way, that whatever the need that leads the user and/or client to interact with the bank, they need to have their digital access tool, and in the event of losing, forgetting or blocking their bank key, they will be able to unlock BCI internet key through this same website.

Who can have BciPass?

As was well mentioned, the services provided by the Chilean credit and investment bank are always in constant development, evolution and revolution, where part of this progress is evident in its innovative product for daily use called BciPass, designed for customers with a current account, premium or single-producer customers, and who also have a credit card, operating from Bci.cl or the Bci App.

The institution assures that in a short time it will bring to the financial market this useful tool for businessmen and entrepreneurs. However, this product requires activation, for which the BCI internet key utility can be used.

How to activate BCI internet key for transfers?

Like any digital instrument, the BCI internet key requires registration and activation, since only then can customers operate and mobilize their accounts and other banking operations. Notwithstanding this activation process that allows transfers and other procedures, some simple guidelines must be followed:

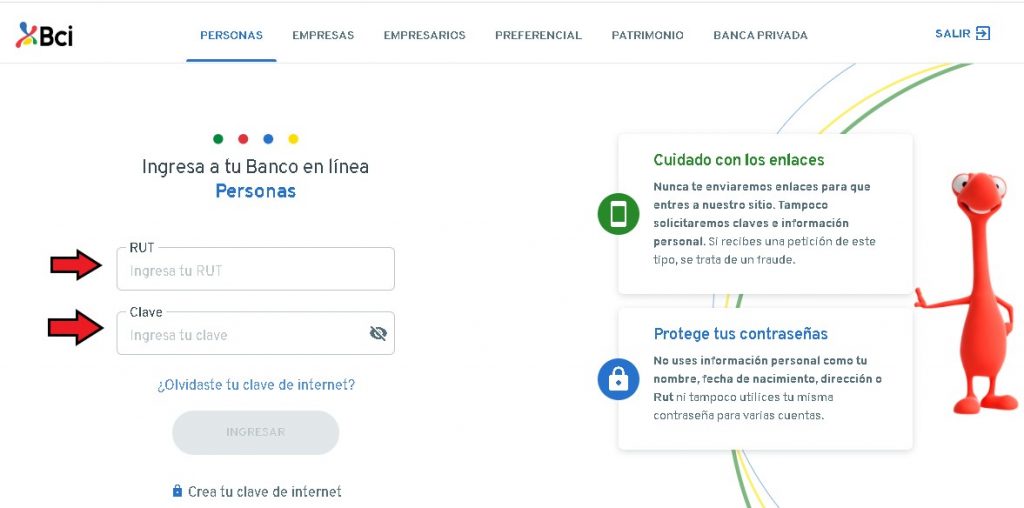

- Access official web portal from BCI Chile.

- Click on the option online bank.

- Then go apply BCI internet key.

- Finally place the Passport and follow the directions (have your identity card handy).

Activate the BciPass transfer key

Likewise, to enjoy the benefits available through the option BciPass, the user must activate their BCI internet key and be able to operate with this service provided by the new mobile App:

- Download the BciPass App, place the RUT and BCI internet key.

- Then provide the verification code that is received in a text message.

- The next thing is to enter the password of the ATM.

- Lastly, you will need to create the numeric key BciPass 6 digits and voila, it is ready to use.

Steps to activate BCI internet key from BciPass

The necessary steps required to activate the BCI internet key from the BciPass App are indicated below, since with this tool the client will be able to carry out a large part of the operations and movements in their financial products and services with the bank:

- As always, proceed to download the BciPass App.

- Then accept the question Allow BciPass to make and manage calls? with the options (Reject/Allow).

- Then supply the RUT/enter BCI internet key/continue.

- Then activate the option Your BciPass, having to opt for (activate in the BciPass App/activate with the help of an agency).

- Then enter the 8-digit verification code received by message.

- Then click on verify account (here the system checks the identity, having to enter the code of the ATM of the debit card).

- Then, to create the BCI Pass internet key (provide a 6-digit key to authorize transactions).

- It is followed by the creation of the BciPass Password (replace the previous 6-digit password to confirm and continue).

- Then, proceed to configure the device (device name), click on start.

- The next thing is to confirm the BCI Pass internet key, but this time by the system.

- When the service is enabled BciPass the user will be able to (authorize transactions from the mobile quickly and safely). This replaces the current MultiPass.

- Ready, by activating the BCI Pass internet key, you can carry out fast transfers and other operations (new beneficiaries can be added without a verification code), by clicking on start.

How to authorize transactions with BciPass?

In this section, some of the basic and most common services that all BCI customers can carry out by simply having or enabling the new and efficient BciPass application, accompanied by the usual website, will be indicated. Its benefits are lost sight of, since The user will be able to save a lot of time, since he will be able to carry out a good part of his operations from his own mobile, among such the following stand out:

Transactions in Bci.cl

Through this modality offered by the bank's web portal, endless operations can be carried out from the comfort of home, being able to carry out transactions in the same way as they usually do from Bci.cl.

This service is requested by opening and entering the BciPass App from the mobile, where they must first download this option and then authorize the operation. What follows is to wait a few seconds for the respective receipt of the operation carried out in Bci.cl.

Transactions in the Bci App

In this case, the procedure is similar to the previous one, and various transactions can also be carried out as usual from the Bci app. To do this, when automatically opening the BciPass App the BCI internet key must be supplied and continue with pressing on authorize and wait on the Bci app to finish the process.

BCI Pass: benefits

Among the benefits reported by the modality offered by the BciPass App, the most used by the users of this important bank can be named. Among the benefits of this modality, the following stand out:

- From the mobile: regardless of the mobile device where the transaction is carried out, the approval will always be from the mobile.

- Add new recipients without the need for a verification email: new recipients can be added more quickly using the BciPass App. And in this way the tedious waiting for the mail is avoided so that the receiver is registered and to be able to carry out the transfers.

- Increases the maximum amount of the first transfer: allows you to make transfers higher than usual, because eventually the client needs to raise the amount to be transferred, and with this great option you can do it quickly.

Can I activate BciPass from abroad?

Yes, now the BCI user or client can activate their BciPass from abroad without any limitation, since they will receive a verification code to their mobile and/or mail. The only requirement is to have a valid Chilean line and a duly authorized mail in My profile.

What is the BCI internet key for?

As was well mentioned throughout this post, the BCI internet key is a multipurpose and utilitarian key, since it authorizes access not only to the web, ATMs, but now to the Lider Bci Card App, in addition to the service My account. Although it should be clarified that the purchase key is different, since it contains 4 numbers, as well as for the dynamic key.

Don't have it or was it blocked?

In case the key is blocked, the user must access the App or My Account with the Rut and their current 4-digit purchase key, and a format will immediately be presented to create the new BCI internet key. Once its filling is complete, it will be ready, a new key is already available.

Did you forget her?

If you have forgotten the BCI internet password, there is no problem, since just contacting 600 600 5757, the current password will be disabled, with which you can access the App or My Account again with the Rut and the purchase password. , after which a form similar to the previous one will open to create a new access key. Upon completion you will be ready.

Don't have a purchase code (4 digits)?

In this particular, if the customer does not have their 4-digit purchase code, they must necessarily go to an agency to request it, specifically in the section Leader Bci Financial Services, available throughout the country.

If you liked this post about the BCI internet key, be sure to check the following links, they may also interest you: