In Chile, the Internal Revenue Service, better known as SII, attached to the ministerial entity of Public Finance, exercises the planning and application of control and inspection actions of the tax collection system in that nation. Like any public control entity, it must seek and implement various digital mechanisms to facilitate and guarantee that those obliged to pay taxes are kept up to date. For proper access to digital profiles, users must manage their access password, and in this post we will tell you how to get SII key to consult and cancel your tariffs in time.

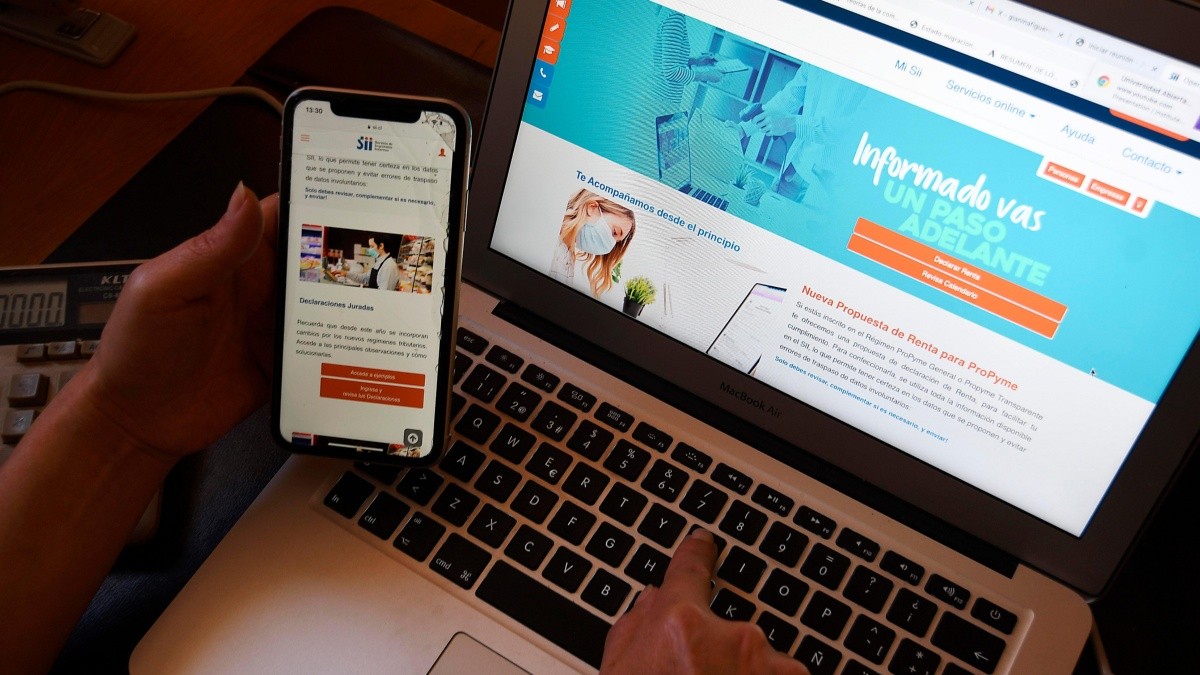

Tax SII key to operate online

The Internal Revenue Service or SII, is a fiscal control entity of the Chilean State. It must therefore apply and supervise all internal tariffs in force or set for the corresponding financial year, whether of a fiscal nature or another nature of interest to the Treasury, and that, in addition, the control is not expressly established and delegated by law to an authority. different from this.

The objective of SII is to lower the levels of tax evasion, as well as to provide taxpayers with various means and services of excellence, in order to optimize and facilitate tax compliance on their own.

Within its tax policies is the key to SII, whose platform is available throughout the day, so that among other procedures, users can pay their taxes, check their account statements, and many other operations. However, if you have forgotten the password to enter the portal, here we will give you the steps on how to recover key from SII, and not wait for the amount to expire.

Therefore, with this convenient option, the user will be able to obtain his new password in order to carry out all the operations that the digital channels of the collection entity, and that it maintains active in its official web portal, and enabled to meet the requirements online of natural and/or legal persons, enter monthly VAT returns, issue fee tickets, operate with electronic invoices, check tax status, among others.

As mentioned, people can access the platform with the SII password at any time, since it remains operational throughout the fiscal year in its digital window, as well as in the physical offices of the SII Internal Revenue Service.

Who is it for?

The SII key applies to all types of people, whether national or foreign, legal (companies), as well as legal spokespersons of anyone obliged to pay taxes, that is, all types of authorized spokespersons can carry out this procedure. This access key is also obtained online, also for natural and legal entities, and other entities without legal personality.

SII key details

The SII, as a public body of fiscal interest, has the objective of applying and supervising all forms of internal taxes in Chile, from which it is understood that those external taxes, such as fiscal tariffs, or of another type where the Treasury has interference, are excluded. and its control is not expressly attributed to a different body. In such a way that its scope of competence delimits, at the same time, that of application of the Chilean tax law.

It is a body functionally dependent on the Ministry of Finance, with a presence through regional directorates in each territorial jurisdiction of the country, and 5 in the Metropolitan area of Santiago, 1 of large taxpayers and their respective National Directorate, in whose spaces 4885 Chileans work. It also has 51 subsidiary Units, the Regional Directorates, and today it has 2 Trade Associations:

- ANEIICH (National Association of Chilean Internal Revenue Officials).

- AFIICH (Association of Internal Tax Auditors of Chile).

What do I need to process the SII key?

It can be said that to join the fiscal tax system, the user does not need any document. Well, if you are a new taxpayer who wishes to process the SSII key for the first time, you must provide some requirements, basically related to personal data, such as the identity number in order to verify the user's identity.

And if you are a taxpayer who has already made previous income or VAT declarations, the system requests the folio number of any of such declarations, the purpose of which is to verify identity.

Likewise, in the event that the family information does not support virtually confirming the identity of the user and the person has not made any income or VAT in recent years, the system will not grant the SII key in the online mode; You must then go personally to a service office and request your password.

https://www.youtube.com/watch?v=OMOrVVMlly8

Validity

Once the system admits the SII key, it will not lose its validity, that is, the taxpayer or user will be able to use it for life, unless the entity modifies the self-management guidelines and requirements on the platform.

How and where to process the SII key?

The space to process the SII key is carried out virtually, unless for some reason the taxpayer must resort to a physical agency to do so. As for the steps to carry out this procedure on the web, it is proposed as follows:

- Click on go to online procedure.

- Then on the SII website, place the RUT, and click on confirm.

- The next thing is to click on obtain secret SII key with personal data.

- Then choose the RUT of the family member to enter, and click on send.

- Then, complete the information requested by the system, and click on send.

As a result of the previous steps, the SII password request is accessed, with which the user is enabled to manage their online services. In which space, in addition, the user can request a new password in case of forgetting.

What is the cost?

The taxpayer should know that under no circumstances does the entity accept managers or intermediaries to manage these services, except those specifically provided by law, and they are totally free.

Legal framework

The regulations that are currently in force on the creation of the SII key are included in Circular No. 58 of 2004, which provides for the entire process for obtaining this web key in the units, as well as the opportunity for users to authorize third parties to process certain available online procedures on your behalf.

What feature should it have?

The SII key requires a minimum of 8, maximum 10 alphanumeric characters, the rest works like any similar digital tool.

When will Tax Code notifications arrive?

The notification of approval of the SII Key will be sent to the user through their email provided in the registry, and this will occur each time a provisional code is granted, whether it is to obtain, recover or change.

What is the temporary code?

The provisional tax code is a form of transitory activation that the SII grants to the taxpayer, with the purpose that he can obtain or recover his SII key, this code will be valid for 48 hours.

If it is not possible to obtain or retrieve my SII password online, what to do?

In the event that it is unsuccessful to obtain or recover the SII password via the web, the user can resort to a call to the help desk at the telephone lines: 22 395 1115/22 395 1000

Role of the Internal Revenue Service (SII)

The functions of SII is to administer, therefore, apply and supervise all the modalities of internal taxes that apply in the country and that are foreseen in the current regulations, as well as fiscal or other activities with fiscal competence, where the control does not is expressly assigned by law to a different authority. Among such functions are:

Administratively interpret all tax provisions, set standards and guidelines to follow, generate and implement instructions and issue orders with the aim of guaranteeing their application and control.

Monitor compliance with tax regulations, such as knowing and ruling as a court of first instance the claims presented by taxpayers, as well as attending the defense of the Treasury before Courts of Justice in trials on the application and interpretation of tax laws.

Generate tax awareness among Chilean citizens as taxpayers, for such purposes they must inform about the destination of taxes and the sanctions that may be subject to not complying with their fiscal duties.

SII: online services available

As part of the set of services that the SII must provide to Chilean citizens, the following are included:

- Tax Code and Electronic Representatives.

- RUT and start of activities.

- Updating of information.

- Administrative Petitions and Other Requests.

- Authorization of Tax Documents.

- Electronic bill.

- Electronic fee tickets.

- Electronic accounting books.

- Monthly taxes.

- Declared jurisdictions.

- Income statement.

- Violations, Payment of drafts and Condonations.

- Turn term.

- Tax situation.

- Inheritances.

- Real estate appraisals and contributions.

- Tax appraisal of vehicles.

If you found this post about the SII Key useful, be sure to take a look at the following links with similar procedures in other countries: